In recent years, the terms impact investing and ESG investing have become increasingly common. However, confusion surrounding their definitions and applications abounds, depending on individual perspectives. This perplexity is not confined to Japan but is a global issue, affecting Europe and the United States, where sustainable finance has surged ahead. Impact investing and ESG investing, being relatively new concepts, often generate confusion. Nevertheless, practitioners actively engaged in sustainable finance are converging on a shared understanding of the distinctions between these two approaches.

In this blog, we, as practitioners in the fields of impact investing and ESG investing on a global scale, aim to elucidate our perspectives. Please note that while our understanding may not be flawless, it reflects a consensus among practitioners.

1. Reasons for the Confusion in Defining Impact Investing and ESG Investing

The primary reason for the ambiguity surrounding these definitions lies in their inherent abstract and conceptual nature. Consequently, different people interpret them differently.

2. Definition of Impact and ESG Investment

Impact Investment (Excerpted from Global Impact Investing Network, GIIN):

“Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.”

ESG Investment (Excerpted from Principles of PRI):

“We define responsible investment as a strategy and practice to incorporate environmental, social, and governance (ESG) factors in investment decisions and active ownership.”

These definitions, on their own, fail to provide a comprehensive understanding of the specifics, details, and differences between these investment methods.

3. Distinction Between Impact Investing and ESG Investing

The classification of impact investing and ESG investing is not based on differences in financial returns but rather on the non-financial information they assess. Contrary to the misconception that impact investing sacrifices financial returns and is unprofitable, there are two types of impact investing: those pursuing financial returns equivalent to general investments (market rate impact investing) and those targeting lower financial returns than general investments (below market rate impact investing). Please note that GLIN practices Market Rate impact investing.

So, how do impact investing and ESG investing differ in evaluating non-financial information? For example, Bob Eccles, Founder of SASB and IIRC, and a professor at HBS/Oxford, explains:

– ESG involves evaluating material risk factors (as defined by SASB, etc.) associated with a company’s operations and activities. It requires internal data for measurement.

On the other hand, Issa Faye, Director at IFC, notes:

– ESG serves as a risk management framework, while impact can be considered a performance indicator, intentionally seeking positive environmental and social returns. Evaluating impact considers metrics such as the amount of clean energy supplied, while ESG emphasizes that clean energy production should not increase energy emissions compared to regular electricity. ESG and impact are complementary and should be used together in the investment process.

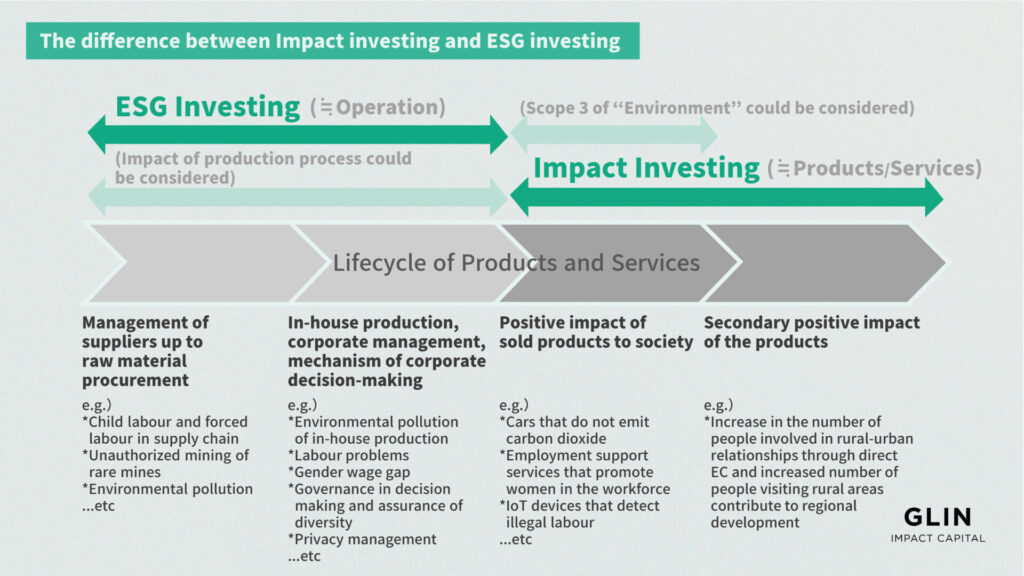

In one word, you could understand the difference between impact and ESG evaluations as ESG focusing on operations-related matters and impact focusing on products and services. The diagram below illustrates this concept.

When viewed this way, many people might realize that what they previously thought of as ESG actually pertains to impact. ESG evaluations often do not include assessments related to the impact , causing companies producing products with a positive societal impact to receive low ESG ratings, while those with products causing negative societal impacts might score highly.

Case 1:

Tesla, initially having a low ESG rating, manufactures cars that emit minimal carbon dioxide, but the ESG rating remained low until recently. This discrepancy led Elon Musk to express dissatisfaction and criticize ESG.

Case 2:

Some gas and oil companies, despite their products causing substantial environmental harm, have high ESG ratings due to significant internal management and ESG compliance improvements.

According to GLIN, it is essential to comprehensively evaluate companies considering both impact and ESG, rather than evaluating them separately.

4. GLIN’s Core Values

GLIN firmly believes that impact investing and ESG investing, though distinct, are equally important and complementary. Consequently, we incorporate both impact and ESG into our investment decisions and assessments.

5. Quiz

Here’s a quick quiz to test your understanding. Is the following content evaluated based on impact or ESG?

1. Initiatives to improve the ratio of female employees and executives at our company.

2. Operating a career site for women that supports women’s advancement in society.

3. Efforts to closely examine whether human rights issues are occurring in the supply chain and stop purchasing from risky suppliers.

4. Initiatives to develop and sell employee mobile IoT devices to check for human rights issues in factories.

In GLIN’s view, 1 and 3 are evaluated from an ESG perspective, while 2 and 4 are assessed from an impact perspective. To simplify, ESG evaluates internal aspects of products and services until they are sold, while impact assesses the positive changes and effects products and services have on society.

In this blog, we’ve highlighted the distinctions between impact investing and ESG investing based on our practical experiences. We hope that this discussion has deepened your understanding of the evolving landscape of impact and ESG-related news and conversations.