The GLIN Impact Capital team is excited to announce the launch of our blog! As part of our owned media, we will share a wide range of insightful articles across various genres pertaining to impactful business practices and ESG on a regular basis. We greatly appreciate your support and are eager to hear your feedback. Your input will play a crucial role in shaping the content and direction of our articles. Don’t hesitate to reach out to us via the contact form to share your thoughts.

For our first blog post, I’d like to take a moment to provide a more in-depth introduction to GLIN Impact Capital, going beyond what you will find on our company website.

GLIN Impact Capital was established in 2020 by a team of individuals who developed a strong passion for promoting the growth of impact investing and impactful startups, both domestically in Japan and internationally, through their extensive education and hands-on experience.

Our mission is to ‘build a better capitalism’ by facilitating a transition that effectively addresses social issues in tandem with procuring economic growth.

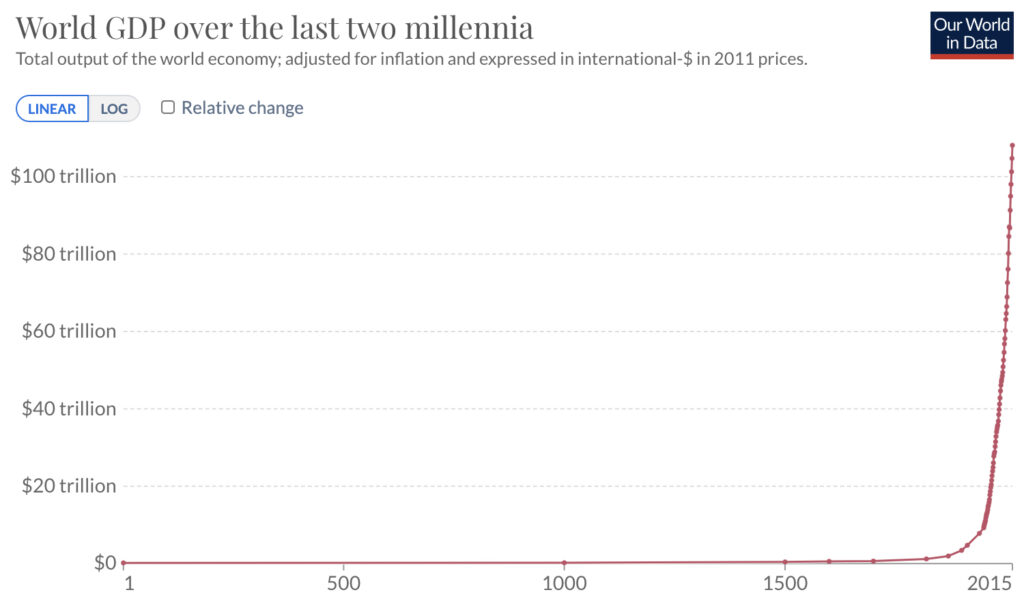

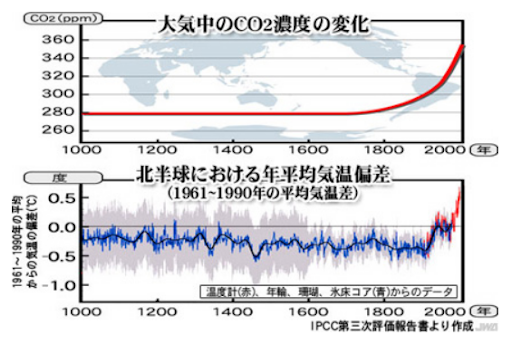

Throughout the past century, we have experienced unparalleled and exponential expansion, as evidenced by the remarkable surge in global GDP. However, this rapid progress has not come without consequences. It has given rise to pressing environmental and societal challenges that demand immediate attention. One prominent example is the issue of climate change and global warming.

Remarkably, the graph illustrating the increase in atmospheric concentration of CO2 closely mirrors the graph depicting the world GDP since 1900, revealing a shared pattern of exponential growth. This correlation underscores the need to address sustainability challenges alongside economic development.

Sources:

- World GDP over the last two millennia: https://ourworldindata.org/grapher/world-gdp-over-the-last-two-millennia

- CO2 emissions and global warming: http://www.funabashi-kantele.jp/study/earthwarm/co2.html

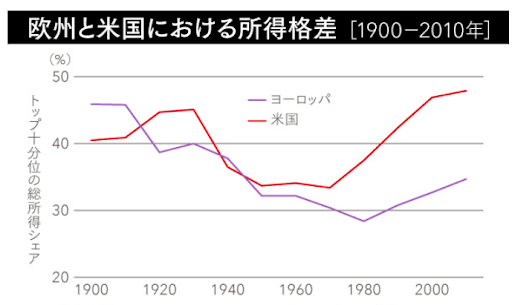

Income inequality has deepened, leading to pronounced disparities in vital domains such as healthcare and education. French economist Thomas Piketty famously expressed the concept of “r>g” in his book “Capital in the Twenty-First Century.” This inequality suggests that individuals who possess assets tend to accumulate more wealth over time, while those who rely primarily on labor income struggle to achieve long-term prosperity. Moreover, this wealth disparity intensifies as the economy expands. We vividly recall Prime Minister Kishida’s statement, where he acknowledged that the trickle-down theory, which posits that economic growth benefits all levels of society, did not materialize as expected. Despite the expectations of wealth redistribution and improved conditions for low-income individuals, the desired changes have not been realized. Furthermore, racial and gender disparities persist as influential entities perpetuate biased narratives and highlight success stories that overlook the challenges confronted by marginalized groups.

Sources:

- “Capital in the 21st Century” by Thomas Piketty: https://pepera.jp/diary/piketty_le_capital/

- Article on income inequality disparities: https://newspicks.com/news/782864/body/

Like all decisions, the pursuit of rapid economic growth comes with compromises. In a book co-authored by Kazuo Inamori and Takeshi Umehara, they emphasize that humanity has justified its actions and selfishly exploited resources, believing that “the capacity of the earth and the universe is so vast that when the perceived risk of externalities is minimal, consequences were often overlooked.” During the 1900s, when economic activity was relatively limited in scope, the societal and environmental impacts of our actions were unquestioned, neglecting the implications of rapid economic growth. However, today’s reality is different: the overall volume of economic prosperity has outgrown its “childhood” phase, and the consequences of our past decisions are catching up.

Amidst the ongoing explosive growth of economic activity, it becomes imperative to inspect our decision-making processes, risk analysis, and financial evaluations—the very pillars of our economy. It is striking that these foundational elements have remained largely unchanged. We have yet to realize substantive change since Milton Friedman’s famous declaration emphasizing that “there is one and only one social responsibility of business—to use its resources and engage in activities designed to increase its profits.” Now, confronted with a behemoth-sized economic reality, we must question whether persisting with the same approach from decades ago is the wisest course of action to tackle the issue of externalities and economic risk associated with environmental and social challenges. A new economic framework is necessary.

In seeking a new principle of making decisions and creating a growth trajectory for humanity, we must acknowledge a crucial belief that pursuing self-realization is a fundamental human need. It cannot be suppressed but must be embraced for the happiness and sustainable prosperity of humankind.

We firmly acknowledge the importance of satisfying one of humanity’s fundamental needs: the pursuit of personal growth and self-realization, as espoused by Maslow’s theory of needs. Our intention is not to stifle this innate need; rather, we believe that unleashing it can pave the way for the happiness and sustainable prosperity of humanity.

With this belief in mind, we aim to contribute to “reimagining capitalism” or, in our context, the transition to a society where solving social issues goes hand in hand with economic growth. One of the most effective ways to achieve this transition is by incorporating external economic factors. This includes the development of methodologies like impact/ESG investment in finance and incorporating non-financial attributes into corporate decision-making, asset management, and investment evaluation processes. By doing so, we anticipate the rise of companies that pursue growth while solving social issues, particularly exemplified by impact startups, and the realization of our vision.

(Note: External economies refer to the positive and negative impacts on society resulting from economic activities. I will explore this topic in detail in a separate article.)

GLIN Impact Capital is a powerful catalyst – a Change Agent – dedicated to accelerating this transition. We prioritize impact/ESG investment, nurturing sustainable and socially inclusive investments. Through our exceptional consulting and advisory services, we also drive transformative changes within large-scale enterprises. Our unwavering commitment involves challenging established models and showcasing our contributions through this blog.

We intend to explore the intricacies and concepts of our various business endeavors and activities in forthcoming articles. We kindly invite you to subscribe to our newsletter to ensure you receive timely updates and global insights. Your unwavering support is truly valued and greatly appreciated.

Thank you,

Masato Nakamura

Partner

GLIN Impact Capital